Insights & News

FourSight: Long Live the Seller's Market

Deja vu all over again

As we’re nearing the end of 2017, reports are rolling in for the third quarter. The big picture, once again: our seller’s market persists.

According to GF Data, which reports on private equity transactions valued between $10-250 million, deal volume is relatively in-line with previous quarters, and sellers continue to command “unprecedented valuations” for high-quality companies.

Looking at the M&A market as a whole this year — despite high valuations and a lack of “quality” targets — private equity firms are still deploying capital, as they’re armed with more than $500 billion in dry powder, per PitchBook Data. Fundraising continues to trend toward the middle market, and given the number of deals announced but not yet closed, Q4 activity is expected to remain robust.

VALUATIONS REACH NEW HEIGHTS (AGAIN)

You may recall a similar story earlier this year. But in Q3, deal multiples (total enterprise value/EBITDA) continued to surge, averaging 7.5x and surpassing the previous quarter’s 7.3x average — which had been the highest recorded in GF Data’s 15-year history. According to PitchBook Data, these numbers are being driven by an abundance of dry powder and high competition for quality deals.

Typically, companies with higher revenue and above-average financial performance garner stronger multiples. But now, valuations are trending upward across the entire deal universe — including smaller transactions (in the $10-25 million range), as well as average performing companies.

DEAL ACTIVITY HOLDS STRONG AND STEADY

GF Data reported on 201 private equity groups and other deal sponsors in Q3 2017. Within that universe, 49 deals were completed — compared to 51 in the previous quarter, and 36 in Q3 2016. For 2017 year-to-date, total deal volume is 162, which is exactly the same number of deals reported by GF Data in the first three quarters of 2016.

ADD-ONS ARE HOT

While valuations were lofty across the board, add-on acquisitions garnered higher multiples compared to platform investments.

This is a trend that GF Data first reported several years ago; traditionally, platform companies achieve higher valuations than smaller add-ons, but that began to change in 2013. The gap has persisted, if not widened, in the past year, as large sponsors focus on growing their existing platform investments.

Current Engagements

A sampling of deals that our team is working on:

- E-Commerce company focused on women’s apparel

- Manufacturing company providing production machinery to the wood working/wood flooring industry

- Ophthalmology practice and related surgery center

- Specialty retailer

- Highway safety contractor

- Manufacturer and distributor of consumer products

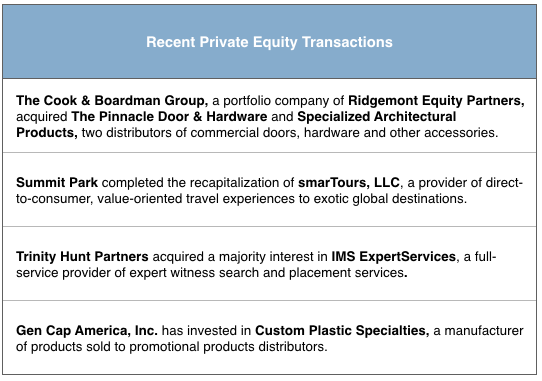

Selling and Searching

Here are a few deals completed by Private Equity Groups in 2017.

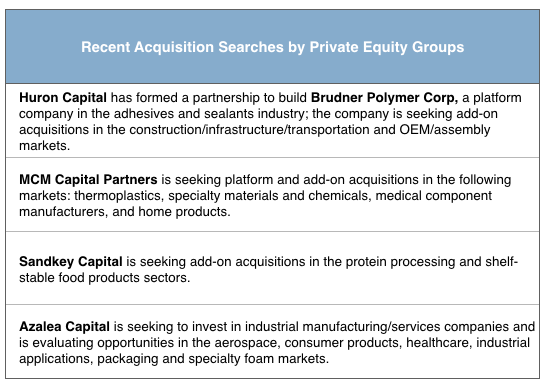

What kinds of companies are buyers looking for? Here are a few recent searches from Private Equity Groups.

If you’ve got questions about what’s happening in your industry, give us a call: 423.266.7490.