Insights & News

What a Business Owner Should Know About Valuation

Prior to joining FourBridges in 2022, John spent four years at Willamette Management Associates, a leading business valuation and forensic analysis firm, and worked in the audit practice of PricewaterhouseCoopers.

Is business valuation art, science, or a little bit of both? From the different approaches used to create them to the varied methodologies and nuances within each approach, formal valuations are inherently complex.

To many business owners, the hundreds of pages of jargon-filled analysis look impressive … but is a formal valuation necessary? The world of valuation is rife with misconceptions. Many business owners wonder if they need a formal valuation in order to sell their business. Spoiler alert: you don’t. However, there are certainly situations where a formal business valuation can be invaluable.

Let’s dig a little deeper to learn about the different types of valuations and how they are typically used, and what type of valuation you need if you’re thinking of selling your business.

Business Valuation Approaches

There are three main valuation approaches: asset-based, income-based, and market-based approaches. Each approach comes with its own challenges, and within each approach a number of different methods can be used.

Asset-Based Valuation

As the name implies, in an asset-based approach, the value of a business is based on the value of its assets and liabilities. The most common method applied here is the Adjusted Net Asset Value Method, in which all of the company’s assets and liabilities are adjusted to market value. The liabilities are then subtracted from the assets to determine the value of the company. Although the asset approach can be applied to an operating company, the cost and time associated with valuing all of the assets and liabilities often discourages its application. More commonly, the asset approach is applied to holding companies.

Income-Based Valuation

The income and market-based approaches are more commonly used for operating businesses. While a number of methods can be applied in the income-based approach, one of the most common is the Discounted Cash Flow (DCF) Method. In this method, the expected future income of a business is projected for a discrete period (typically five years). The expected future income is then discounted back to present value using a present value discount rate.

This approach can be challenging for smaller companies that may not have a five-year business forecast. Likewise, calculating an appropriate present value discount rate can be challenging for smaller companies, as reliable published data may not be available.

Market-Based Valuation

Two methods are commonly applied in the market approach: the Guideline Publicly-traded Company (GPC) Method, and the Guideline Transaction Method (GTM). In the Guideline Public Company Method, publicly traded companies that are similar to the company that’s being valued are identified. Reported metrics such as revenue or earnings are compared to the public company’s market value to derive a pricing multiple. This pricing multiple is applied to the revenue or earnings of the company being valued.

For example, if a publicly traded company reported $1B in revenue and the market value of the company was $500M, the revenue multiple would be 0.5x. If the company being valued reported $20M in revenue, you could apply the multiple of 0.5x to arrive at an estimated value of $10M.

The Guideline Transaction Method relies on published data for similar companies that have been acquired. The purchase price of the company that has been acquired is considered, along with the reported revenue or earnings metrics, in order to determine the multiple to apply to the company being valued.

Common Misconceptions About Business Valuation

One of the most common misconceptions about formal business valuation reports is that they’re definitive. After all, some well-credentialed people at a professional valuation firm took a lot of time and effort to put together 100+ pages of in-depth analysis.

Formal valuation reports often contain lengthy boilerplate sections in order to comply with certain standards (legal, tax, and other).

In reality, there is not one “correct” value. If you received 10 different appraisals, you will undoubtedly get 10 different values. Generally speaking, the value of a business is best expressed as a range of value rather than a point estimate.

The reliability of a valuation also depends on the quality of the numbers and assumptions that were applied. For example, if a company doesn’t typically prepare a 5-year forecast, the valuation may be unreliable if the forecast is unreasonable. As we like to say: garbage in, garbage out.

Oftentimes formal valuations for companies in the lower middle market are higher than what similar companies are actually trading for in a sale. This may be caused by a number of factors, including a lack of relevant data necessary to develop a reliable valuation.

Perhaps the biggest misconception about a formal valuation is that you need one to sell your business. A business is worth what a buyer is willing to pay for it — it’s all in the eye of the beholder. That said, when it comes to putting a value on a business up for sale, a common formula comes into play:

The “Real” Valuation Formula When Selling Your Business

When estimating the value of a business for sale, our team reviews the company’s financials and then does a market test to get an accurate check among actual buyers in order to provide a range of value that we think the seller might be able to achieve.

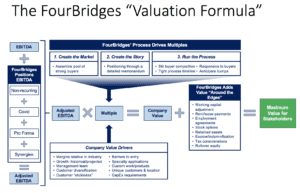

This formula is a bit more complicated than EBITDA x Multiple = Price. For starters, there are adjustments to be considered for the EBITDA, and the multiple will be directly impacted by the competition and the buyer landscape.

A number of value drivers can also impact the multiple, including growth, management team, and customer diversification, to name a few. You also have to factor in everything “around the edges,” which can include anything from stock options to retained assets. In our world, the true valuation formula looks a little something like this:

When does it make sense to get a formal valuation for your business?

Generally speaking, a business owner may need a formal valuation for tax purposes or to help facilitate a transfer of ownership (among other reasons). Sometimes a formal valuation can be helpful for setting strategic growth objectives or developing succession plans.

Find Out What Your Business is Worth

Needless to say, a lot of factors go into determining what your business is worth in terms of what a buyer might pay for it — many of which aren’t always found in a formal business valuation report. Learn more about how to determine what your business is worth, and why. Questions? Get in touch.